Can you ever imagine applying for a loan without doing piles of paperwork? This is possible with the AA account by RBI. This system is ideal to keep track on your financial information and assist you with real-time data and advices to make financial decisions. The RBI account aggregator framework helps ease this financial management. Here is more about how and why is it largely equipped in India.

What is an AA Account?

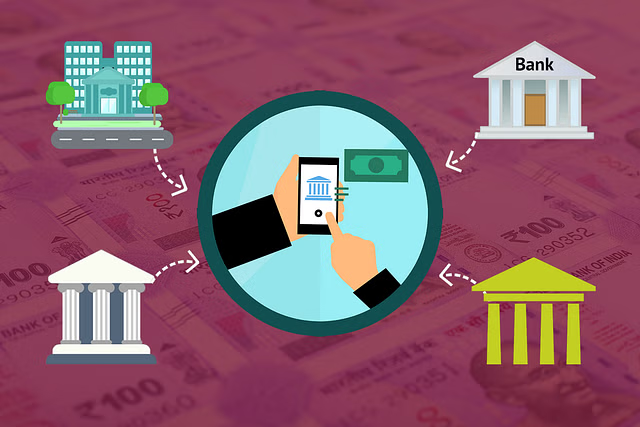

An AA account is not like other traditional accounts. This is a virtual platform introduced by RBI to bring multiple financial institutions under one account. You can think of it as a central hub where all your bank accounts, investment portfolios, and financial holdings are integrated. Platforms like Ciaobucks provide helpful information about bank statement charges, making it easier to understand the data shared through your AA account. It promotes the following features.

Secure Data Sharing

Before the introduction of account aggregation, applying for financial products revolved around submitting numerous documents in banks and institutions. It was not only a long procedure but it was also about questionable data security. The AA account by RBI addresses these issues smoothly in the following way:

Puts You in Control:

You get control on which financial information to share, which financial institutions to associate and for how long. This control helps you to make informed decisions with financial data.

Enhanced Security:

AAs are Non-Banking Financial Companies that gain special licenses from the RBI. They follow a set of stringent data security protocols to ensure complete safety of personal and financial information. This minimises the risk of potential breaches.

Convenience:

Now people do not have to fill numerous application forms or try to get a bank statement. With the RBI account aggregator framework, all your financial information is readily available. Authorised institutions can access it with your consent, streamlining the application process.

What are the Key Benefits of AA system by RBI?

AA system benefits the users in several ways.

Personalised Financial Products:

You can get personalised financial suggestions and products by permitting financial institutions to view finances after taking consent. You can even get better interest rates on loans on the basis of the financial picture viewed.

Improved Creditworthiness:

AA account by RBI helps people with limited credit histories to get more financial stability. These help to demonstrate more financial responsibility to potential leaders by sharing the data for bill payments and investments.

Financial Comparison and Management:

AA platforms help to aggregate financial data from multiple sources, allowing you to easily witness your income, expenses, investments, and overall financial health. This precise and accurate data helps you to make more informed financial decisions and fix your financial goals accordingly.

Data Privacy and Security:

AA framework is built with keeping safety and security in mind. The RBI account aggregator frameworkis designed with data protection measures to ensure the safety of financial information from several institutions. Account Aggregators follow data encryption standards and do not store any user data, which minimises the risk of data breaches.

Standardised Data Formats:

The framework designed by RBI promotes the use of standardised data formats to ensure uniformity in data sharing. This reduces errors, streamlines processes, and facilitates easier integration of data over multiple financial institutions.

Interoperability:

The account aggregator framework promotes interoperability among various financial institutions. This means that data can be shared seamlessly across different types of financial service providers, enhancing the efficiency and accessibility of financial services.It streamlines procedures for both customers and financial organizations by minimizing the need for repeated submissions of the same data to different institutions.

What are the Evolving Features of the RBI Account Aggregator Framework?

The AA framework is constantly evolving with advanced features and functionalities. Here are a few.

Increased Adoption and Integration:

With time, more financial institutions are expected to curate an account aggregating eco-system, as it increases the breadth of financial data. This eco-system will land multiple types of financial institutions like banks, insurance companies, fintech companies, investments, and more. This broad participation will provide better financial insights to the users.

Enhanced User Experience:

Thanks to technological developments and growing familiarity, the AA framework is designed to provide a better user experience. In order to streamline processes and obtain consents, financial institutions will provide more user-friendly applications and interfaces that allow them to examine their financial data in a consolidated way.

Integration with Digital Lending Platforms:

There have been some fascinating advancements with these digital lending platforms. It can facilitate the loan approval process by giving lenders immediate access to validated financial information. By doing this, fewer manual document submissions and verifications are required. Furthermore, it provides more useful insights into the lending process, which is advantageous to lenders as well as borrowers.

Regulatory and Policy Enhancements:

As the AA framework develops, the regulatory and policy environment will undoubtedly grow. The rules are formally modified by regulatory authorities like as the RBI to reflect new issues and possibilities. This entails strengthening data protection regulations, providing more precise guidelines for data exchange, and making sure the system continues to be open and understandable to all facets of society.

Bottom Line

Financial data management is increasingly reliant on the RBI account aggregator framework. AA accounts have made life easier for consumers by giving them more control over their financial information and enabling safe sharing. This has made the financial ecosystem more effective, convenient, and safe. We may anticipate additional advantages for people in managing their money and reaching their financial objectives as the framework develops.

Because of this, apps like Anumati are quickly becoming the go-to resource for those seeking professional financial advice and security. Using a platform that provides guidance, manage your funds on Anumati and increase your ability to make decisions.

Manage your finances on Anumati and improve your decision-making authority with a platform that guides you.

So, take control of your financial data, explore AA accounts, and experience the latest financial management methods.